“Community Wealth Building is about keeping the wealth, money, or economy local. By keeping things local it allows the money to circulate around the local economy. The money goes back in people’s pockets and back into local businesses. By keeping it a local community level means that it doesn’t get extracted away to other head offices of corporations that are not based in the local community. Grow the local community and it makes it more resilient and a better place for people to be.”

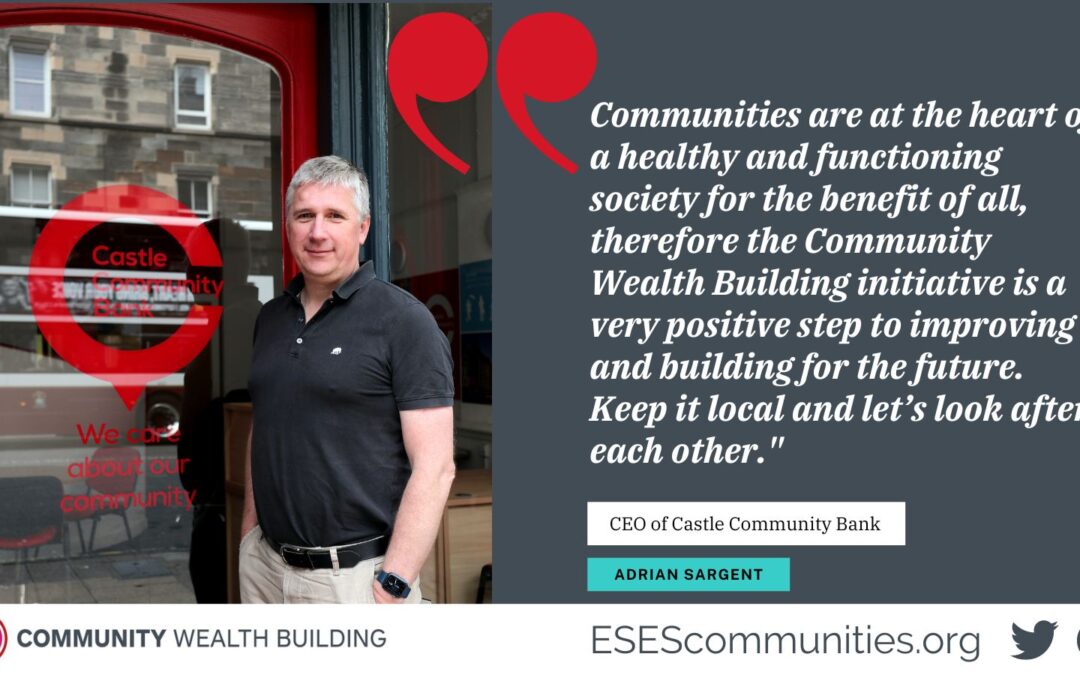

Chief Executive of Castle Community Bank, Adrian Sargent, shares his thoughts on building community wealth:

“Community Wealth Building can be categorised under five pillars:

- Shared ownership of the local economy

- Making financial powers work for local places

- Fair employment and just labour markets

- Progressive procurement of goods and services

- Socially just and productive use of land, property and assets

“Designed to harness the economic leverage of local ‘anchor’ organisations to tackle long-standing systematic challenges and structural inequalities within our communities, community wealth building seeks to transform local systems to enable local people to have a stake in and benefit from the wealth our economy generates. It can deliver more and better jobs, business growth, community-owned assets and shorter supply chains creating better resilience.

Purpose alignment

“Within the credit union sector and Castle Community Bank, two of the pillars resonate really strongly. ‘Shared ownership of the local economy’ is wholly aligned to the purpose and values of our member owned organisation. We’re here for our community, our members, and we wish to give back and make sure we build our local community. The other is ‘making financial powers work for local places’. That really is core to way that we think and the way that aligns to our values and our purpose.

“We are a financial institution, we want to ensure that we can educate the local community, work with social enterprises, build that wealth within that local community.

“Castle Community Bank is a social enterprise, and there for our members, we aren’t beholden to large corporates or the stock market, so what we do is always in the best interests of our members.

Together, the community wealth building efforts of Castle Community Bank and other organisations, can help to create a more resilient and inclusive place to live, work and thrive.

“Community Wealth Building is something that is core to credit unions, and I can see that, as we focus more on this as a society, there will be a greater place for credit unions to ensure improved financial inclusion, giving back to our members, giving back to our community. Doing what we can in our community – be that offering fair savings products for our customers and our members in the local community, or offering good value loans to businesses, social enterprises and not-for-profits – keeping money within the local community for the betterment of that community.

Keep it local

“Community Wealth Building is important to myself, it keeps things local, it allows services and businesses to be there for the local community. It keeps the money in the local community to regenerate that particular area, which can then hopefully see high streets being regenerated as well, and to allow the people living in the community to have more services on their doorstep.

“Together, the community wealth building efforts of Castle Community Bank and other organisations, can help to create a more resilient and inclusive place to live, work and thrive.

“Watch this short film from ESES featuring our bank and other community organisations striving to make a difference in our region.”

Watch

Related links

https://castlecommunitybank.co.uk/about/