Financial Support

Useful tools and information to help manage your financesWe are here to help

We have a wide range of information and tools available to help you better manage your money.

If you are struggling with debt, need help budgeting or want to check out how to best detect the latest fraud and scams, please visit the relevant sections below for more information.

Debt management

The financial well-being of Castle Community Bank Members is our priority.

There are a variety of reasons you may find yourself struggling with debt, many of which can be beyond your control. According to the debt charity Stepchange, the top 3 reasons for calls to their helpline are:

- Reduced income

- Unemployment or redundancy

- Injury or illness

Castle Community Bank are a responsible lender and we want to work with our customers and help when difficulties are encountered. So, if you are experiencing debt problems, please make sure that you get help straight away by speaking to us before it spirals out of control.

Free help and advice when it comes to debt problems

The organisations below are also sources of free help and advice when it comes to debt problems.*

-

Stepchange

A free confidential service to help achieve realistic solutions to debt problems.

-

Citizens Advice Bureau England and Scotland

The Citizens Advice Bureau provides free, confidential and impartial advice on debt.

-

AdviceUK

The largest UK network of advice-providing organisations.

-

Money Helper

A government run bureau that provides help and guidance on a number of aspects including debt, benefits and retirement options

-

National Debtline Helpline

The National Debtline Helpline provides free and independent debt advice

-

Breathing Space England

Government guidelines for debt respite scheme.

Energy suppliers who offer grants

Here’s a list of energy suppliers who offer grants to their customers:

-

British Gas Energy Support Fund

You can apply for a grant on the British Gas Energy Trust website

-

Scottish Power Hardship Fund

Scottish Power have a Hardship Fund available, you can check their website for more information and to apply

-

Ovo Energy Fund

Ovo Energy have a Fund available, you can check their website for more information and to apply

-

E.ON Energy Fund

E.ON Energy have a Fund available, you can check their website for more information and to apply

-

E.ON Next Energy Fund

E.ON Next Energy have a Fund available, you can check their website for more information and to apply

-

EDF Energy Customer Support Fund

EDF Energy have a Customer Support Fund available, you can sign up to the priority services register to apply for a grant on the EDF Energy website

-

Bulb Energy Fund

Bulb Energy Energy have a Fund available, you can check their website for more information and to apply

-

Octopus ‘Octo Assist Fund’

Octopus have an Octo Assist Fund available, you can check their website for more information and to apply

If residents can’t get a grant from their own supplier, they might be able to get a grant from the British Gas Energy Trust. These grants are available to anyone – you don’t have to be a British Gas customer to be eligible.

Simple Energy Advice

Members may also be able to access local grants and you can see what’s available in your area on the Simple Energy Advice website.

Struggling with your debt obligations?

When struggling with debt it can lead to feelings of depression or distress, the following organisations are there to help people in need of assistance.

-

Breathing Space

Breathing Space is a free, confidential phone and web based service for people in Scotland experiencing low mood, depression or anxiety.

-

Samaritans

The Samaritans are here to help, for whatever you are going through, they are available 24/7 to talk

Your local authority website can also be a source of advice specific to your area.

*Please note these are links to external sites. Castle Community Bank is not responsible for the content or views expressed on them

*Please note these are links to external sites. Castle Community Bank is not responsible for the content or views expressed on them

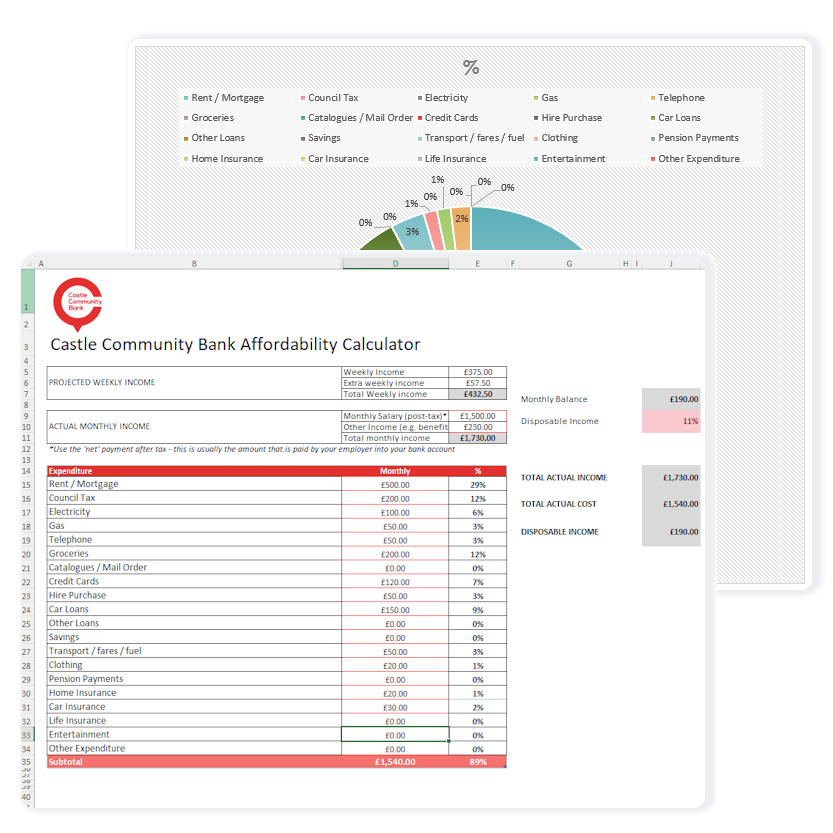

Budget Planner

Our free budget planner may help you to identify your outgoings and where changes may be made such as where these can be reduced.

It may also help you to see if you have enough money left to cover any additional borrowing e.g. a loan or mortgage. To download the planner, please click the link below.

See also the link to the Inbest benefits calculator here to help you find out if you’re eligible for any benefits.

DISCLAIMER: The results provided by the budget planner are based on certain assumptions, including the data entered by the user. The budget planner does not account for individual needs or circumstances. The results generated are for reference only, it does not and is not intended to constitute financial advice. Castle Community Bank shall not be liable for any errors or omissions (human, mechanical or otherwise) in or for any reliance placed upon the results by anyone; nor shall it be liable for the consequences of any decision or action taken upon or as a result of the information or results provided by the budget planner.

Fraud Awareness

Be Fraud Aware. Follow our checklists to help you protect yourself against clone websites and scams. Be vigilant, if it sounds too good to be true, it probably is.

Beware of Scams

Castle Community Bank is the trading name of North Edinburgh and Castle Credit Union Ltd authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (FCA Firm Reference Number: 213877).

Clone firms may purport to be North Edinburgh and Castle Credit Union and/or Castle Community Bank. Please note that https://castlecommunitybank.co.uk/ is North Edinburgh and Castle Credit Union’s only website and we have no other domain names. Please note that we do offer loans and deposits on comparison websites, through our trusted broker My Community Finance.

Be extra vigilant if a website other than this one states that they are the trading name of North Edinburgh and Castle Credit Union and/or Castle Community Bank as they are likely to be fraudulent.

Identifying Clone firms

Clones operate by stealing the details of genuine firms regulated by the FCA and pretend they are their own. They may hijack our name and imitate our website with tweaks to some or all of our contact details

So when you go on to check their credentials it can appear as if you’re dealing with a genuine company.

Be warned that if you proceed with an investment through one of these clones, you’re likely to lose any money your part with, as there is no protection from the Financial Services Compensation Scheme.

We cannot rule out the possibility that our trading name, logo and/or address will be, or has been, used to try and defraud the public through false correspondence. This type of fraud may be via email, text message or by using a website, any or all of which purport to originate from Castle Community Bank. The fact that an email or message of any kind appears to come from Castle Community Bank or North Edinburgh and Castle Credit Union does not, of itself, guarantee that the message is legitimate.

Your best defence is not to fall foul of a clone firm in the first place.

Follow our checklist to help you protect yourself against clones:

- Ignore unsolicited emails and calls

Do not be taken in by phone calls or emails that arrive out of the blue offering tempting investment opportunities.

- Apply caution when responding to social media ads

Beware of advertisements that pop up on social media promising high investment returns and steer you towards websites that are probably fake.

- Do not click on to the link they send you

Even if you think an approach might be genuine do plenty of research before going ahead. Don’t click on to any links or attachments contained in an email – instead search online for the genuine company’s website address and contact them direct via the general switchboard number. Don’t forget clones often imitate real company websites – mimicking colour schemes and wording and using logos from regulators to add an air of legitimacy – but any phone numbers are likely to lead you only to the scammer.

- Check the FCA register

Always check the FCA register for the company’s phone number, email and address and use these to make contact rather than those that appear on the website you’re directed to. Some scammers might claim the official FCA details are out of date, but do not be swayed by this.

- Pause for thought

Don’t be rushed. However plausible a sales person comes across, don’t be rushed into agreeing a deal. If the returns promised seem too good to be true, they almost certainly are and at the very least the arrangement will be high risk. More likely, you could become a victim of an outright scam, and any money you hand over will be lost and unrecoverable

If you’ve any doubts about an investment offer then don’t proceed. Legitimate companies won’t pressurise you to move money quickly. Never give out bank or credit card details unless you’re confident you know who you’re dealing with.

Castle Community Bank strongly cautions the public against sending funds where they have been advised of a change of account details or been advised of different account details that those first advised by Castle Community Bank.

Steps to check before handing over any money

If you are offered deposit products or lending solutions, you should take these steps before handing over any money:

- Get the name of the person and organisation contacting you

- Check the Financial Services Register to ensure they are authorised

- Use the details on the FCA Register to contact the firm

- Call the FCA Consumer Helpline on 0800 111 6768 if there are no contact details on the Register or you are told they are out of date

- Search the FCA list of unauthorised firms and individuals to avoid doing business with them

Are you dealing with the real Castle Community Bank?

Are you dealing with the real Castle Community Bank?

- Verify Castle Community Bank’s website and contact details at https://castlecommunitybank.co.uk/ or the FCA’s register

- Castle Community Bank will have no liability whatsoever for any and all losses and/or damages suffered by anyone who falls victim to such deception. Castle Community Bank hereby disclaims all such correspondence and messages and warns its customers and the general public to disregard these and to exercise extreme caution at all times.

How to Report a scam

Report a scam

- If you are approached about a scam or you believe that you are a victim of fraud, you should tell the FCA using the fraud reporting form, where you can find out about the latest scams. You can also call the Consumer Helpline on 0800 111 6768.

- If you have already paid money to fraudsters you should contact Action Fraud on 0300 123 2040.

- You may also report to our trusted partner My Community Finance: cybersecurity@mycommunityfinance.co.uk

Find out more about scams and how to spot them

- ScamSmart is a great resource provided by the FCA to help you identify, avoid and report scams.

- Read about Take Five, a national campaign to help everyone protect themselves from preventable financial fraud

REMEMBER: if it sounds too good to be true, it probably is!

Benefits Calculator

Over 8 million UK households are missing £16 billion in benefits. We work in partnership with Inbest to help ensure that you receive all of the benefits that you’re entitled to.

The Benefits Calculator will help you to understand your entitlements to Universal Credit, Pension Credit, Child Benefit, Council Tax Reduction and Help to save.